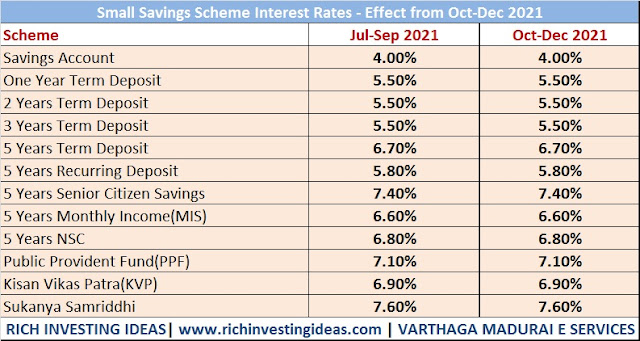

Small Savings Scheme interest rates for the period - October to December 2021

Small Savings Scheme interest rates for the period - October to December 2021 Interest Rates on Small Savings Scheme were announced recently for the period between October - December, which is the third quarter of the current fiscal year 2021-22. The rates are subject to change on a quarterly basis. According to the data released by the Ministry of Finance, the interest rates are unchanged from the current rates which is said in the July to September 2021 quarter. So, there is no change in the rates for the period of October - December 2021. Most of the Savings plan were available in Banking and Postal Offices are coming under the Small Savings Scheme, Ministry of Finance. For the Term deposit of one year, two year and three years the interest rates are said to be 5.5 Percent. However it is 6.7 Percent for the 5 years Term Deposit savings plan. The 5 years Senior Citizen Savings Scheme(SCSS) comes with 7.4 Percent and 5 years monthly income scheme which provides 6.6 Percent rate unde