Best 5 Funds to invest in 2022 - Mutual Funds

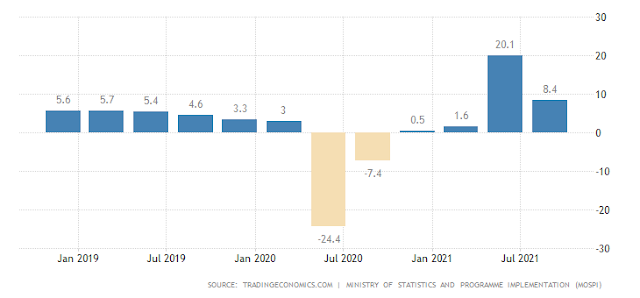

Best 5 Funds to invest in 2022 - Mutual Funds If there was an opportunity to invest heavily in the Equity Market post 2008, it would be the year 2020 - Covid-19 Market Crash. The Global lock down and Economic Downturn caused by the Epidemic may have brought some good fortune to the Equity investors. Most people who fail in the Stock investing fall into two factors - Greedy(Quick rich) and making the wrong investment decision while timing the market. So, never try to time the Market. Upside and Downside are the nature of the Mr. Market. However it always help to build the great wealth, importantly beat the inflation. Those who make a series of long term investments without any temptation in the volatile are always get succeed. No one can guide you to the wealth for Free. Therefore, attention should be paid to those receive the Advise or recommendation. If you don't have a time to analyse and invest in the Direct Equity Market, then you can have a Mutual Funds managed by the Fund m