Rising Gold Reserves - Indian Economy 2020

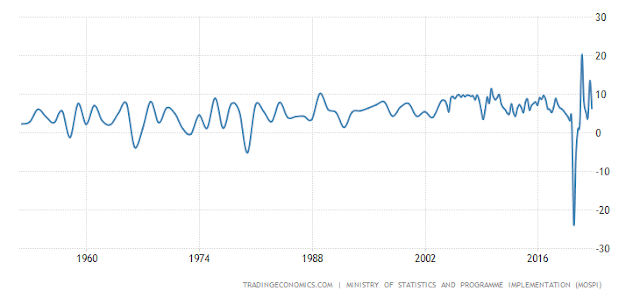

Rising Gold Reserves - Indian Economy 2020 As the Global Indices (Stock Market) continues to rise, the investment in Gold is in consolidation phase as in volatile in the recent weeks. India has been in slowdown on Economy since the year 2018. Accordingly, the Global economic indicators are also not in a favorable position. The Price of Gold, which has not risen between 2011-2018, however it has risen sharply over the past year and a half. The Gold ETF schemes has generated around 38 Percent returns in the last one year. Meanwhile, the BSE Sensex has grown by only 6 Percent in the past 52 week period. India's Trade deficit is rising again after Unlock of Covid-19. The Balance of Trade at the end of August 2020, was USD 6.77 Billion. Exports fell 13 Percent to USD 22.7 Billion, where imports fell 26 Percent to USD 26.47 Billion. Exports of Gems and Jewellery, Petroleum products declined significantly in the month of August 2020. But the Gold imports rose to USD 3.7 Billion last month...