Infosys Limited - FY24 Results & Insights

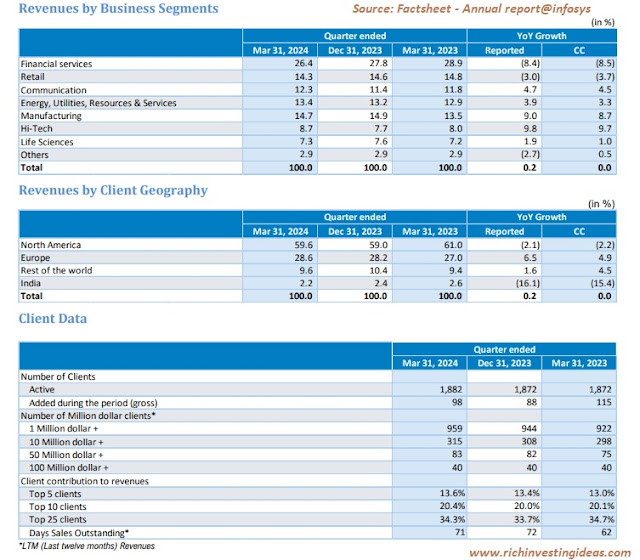

Infosys Limited - FY24 Results & Insights India's second largest Information Technology (MNC) Company - Infosys were announced it's Q4FY24 and Financial year ending 2024 results today. We know that Infosys Limited is a Debt Free and Cash Rich Company in India. When we look at it's Operating Profit Margin(OPM) by every year, it is beyond 20 Percent always. So that it is managing well it's expenses on Total Revenue. However, it is increasing it's borrowing cost for the past 5 years. As on Financial year ending March 2024, the borrowing cost seems Rs.8,359 Crore and the Cash Equivalents were stood at Rs.14,786 Crore. Let's see how it was performed in the last Financial year 2024 (Data below as Consolidated Statement - FY24), FY2024 vs FY2023: Revenue: Rs.1,53,670 Cr vs Rs.1,46,767 Cr Operating Profit: Rs.36,425 Cr vs Rs.35,130 Cr Operating Profit Margin(OPM): 24 % vs 24% Net Profit: Rs.26,248 vs Rs.24,108 Balance Sheet & Cash Flow: Reserves(March 2024):...