Infosys Limited - FY24 Results & Insights

Infosys Limited - FY24 Results & Insights

India's second largest Information Technology (MNC) Company - Infosys were announced it's Q4FY24 and Financial year ending 2024 results today. We know that Infosys Limited is a Debt Free and Cash Rich Company in India.

When we look at it's Operating Profit Margin(OPM) by every year, it is beyond 20 Percent always. So that it is managing well it's expenses on Total Revenue. However, it is increasing it's borrowing cost for the past 5 years.

As on Financial year ending March 2024, the borrowing cost seems Rs.8,359 Crore and the Cash Equivalents were stood at Rs.14,786 Crore. Let's see how it was performed in the last Financial year 2024 (Data below as Consolidated Statement - FY24),

FY2024 vs FY2023:

- Revenue: Rs.1,53,670 Cr vs Rs.1,46,767 Cr

- Operating Profit: Rs.36,425 Cr vs Rs.35,130 Cr

- Operating Profit Margin(OPM): 24 % vs 24%

- Net Profit: Rs.26,248 vs Rs.24,108

Balance Sheet & Cash Flow:

- Reserves(March 2024): Rs.86,045 Cr

- Cash & Cash Equivalents: Rs.14,786 Cr

- Free Cash Flow: Rs.23,009 Cr

Capital Allocation Policy:

Effective from Financial Year 2025, the Company expects to continue its policy of returning approximately 85% of the Free Cash Flow cumulatively over a 5-year period through a combination of semi-annual dividends and/or share buyback/ special dividends subject to applicable laws and requisite approvals, if any. Under this policy, the Company expects to progressively increase its annual Dividend Per Share (excluding special dividend if any).

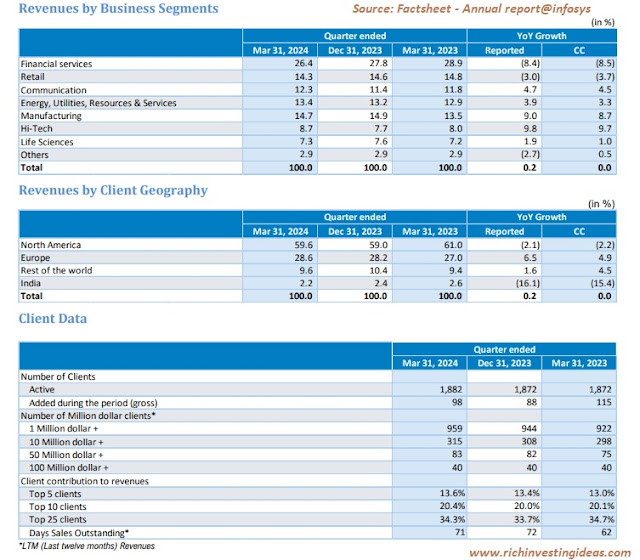

Revenue - Segment wise:

Dividend:

Recommended a final dividend of ₹20/- per equity share for the financial year ended March 31, 2024 and additionally a special dividend of ₹8/- per equity share*.

(*Previous Dividend amount in the FY24: Rs.18 per Share as interim Dividend)

Tracking the Profit and Loss Statement (Consolidated):

AGM and Record Date:

1) The 43rd Annual General Meeting of the Members of the Company will be held on Wednesday, June 26, 2024 (Yet to be announced whether it's physical or Online).

2) The record date for the purpose of the Annual General Meeting and payment of final dividend and special dividend is May 31, 2024. The dividend will be paid on July 1, 2024.

Valuation(as per FY2024 Report):

Infosys Limited is worth between Rs.1024 - 1,280 per share, based on Discounted Cash Flow Method and Rs.1,150 per share based on PE(Price to Earnings) Valuation with expected returns of 12 Percent p.a.

Comments

Post a Comment