India's Trade Deficit -Q1FY23 - A Brief Overview

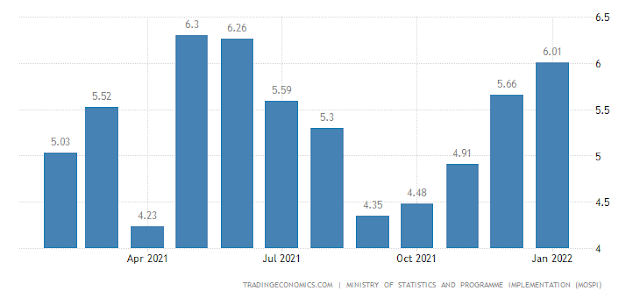

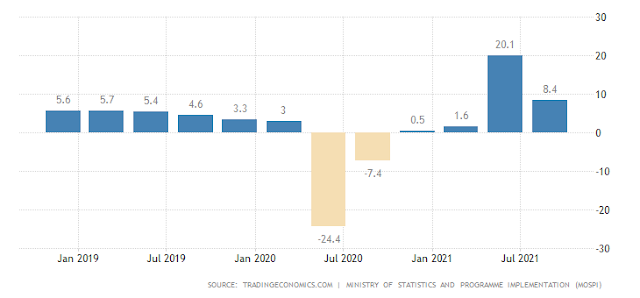

India's Trade Deficit - Q1FY23 - A Brief Overview The Nation's Trade Deficit stood at USD 30 Billion at the end of July 2022. Imports were increased by 43 Percent and the Exports increased by 2.5 Percent. The Export volume was USD 66.27 Billion and the Imports at USD 36.27 Billion. Generally, the gap between Exports and Imports is called as Trade Deficit (EXIM) or Balance of Trade. India's Major imports are Mineral Fuels, Oil, Iron and Steel, Pearls, Precious Stones and Jewellery. Exports include Petroleum products, Jewellery, Vehicles, Grains, Machinery, Pharmaceutical products and Chemicals. In terms of Imports, we mostly get Goods and Services from China. In the year 2021, China were contributed 16 Percent of India's Total Imports, followed by 7.6 Percent from the United Arab Emirates(UAE) and 7.3 Percent from the United States. It is noteworthy that China's contribution alone is about USD 87.50 Billion. We are getting Electrical and Electronic Equipment, Machi...